How to give great employee performance reviews

A Dropbox Sign blog about

All articles

Sign contracts 80% faster

Go paperless with Dropbox Sign.

Try Dropbox Sign

The foolproof guide to creating the perfect hiring sequence

Build a simple, streamlined, easy to follow and execute hiring process so that positive candidate experience becomes standard.

Download

Sales tips

5

minute read

How to turbo-charge your CRM with eSignatures (and why it’s the key to growth)

Human resources advice

5

minute read

Slow hiring process? Here are 5 ways to optimize your time-to-hire

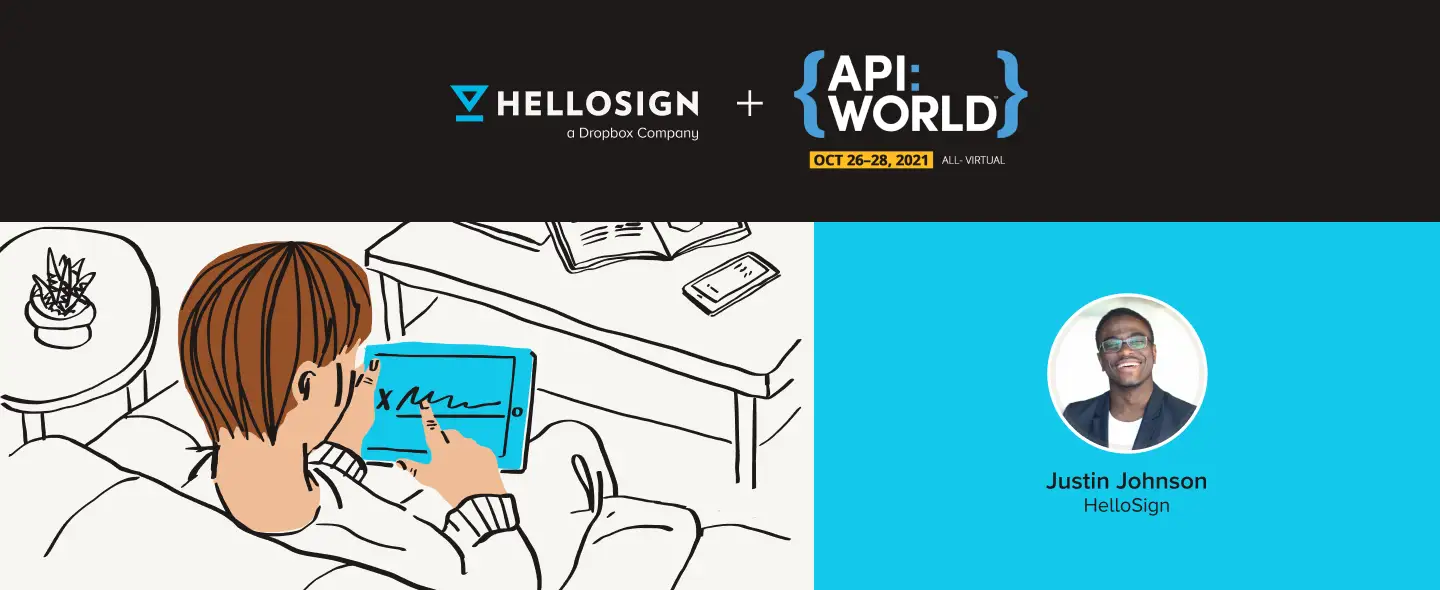

Dropbox Sign integrations

Ready to experience our new and improved Dropbox Sign for HubSpot integration?

We’re offering new Dropbox Sign users 50% off the first year!

Start your free trial

![How To Boost Buyer's Confidence [Updated 2023] editorial illustration](https://assets-global.website-files.com/6446df33610093270e7fb677/645a79cf551d724a508f6ce3_6449bddbf539fc2c4cbafc7f_uc.webp)

![How To Boost Buyer's Confidence [Updated 2023] editorial illustration](https://assets-global.website-files.com/6446df33610093270e7fb677/645a79cf551d720f3c8f6ce4_6449bddbf539fc49dabafc81_uc.webp)

.webp)